4 Simple Steps to Catapult Your Financial Goals

This post may contain affiliate links which means that I will receive a small commission for purchases made through those links, at no cost to you.

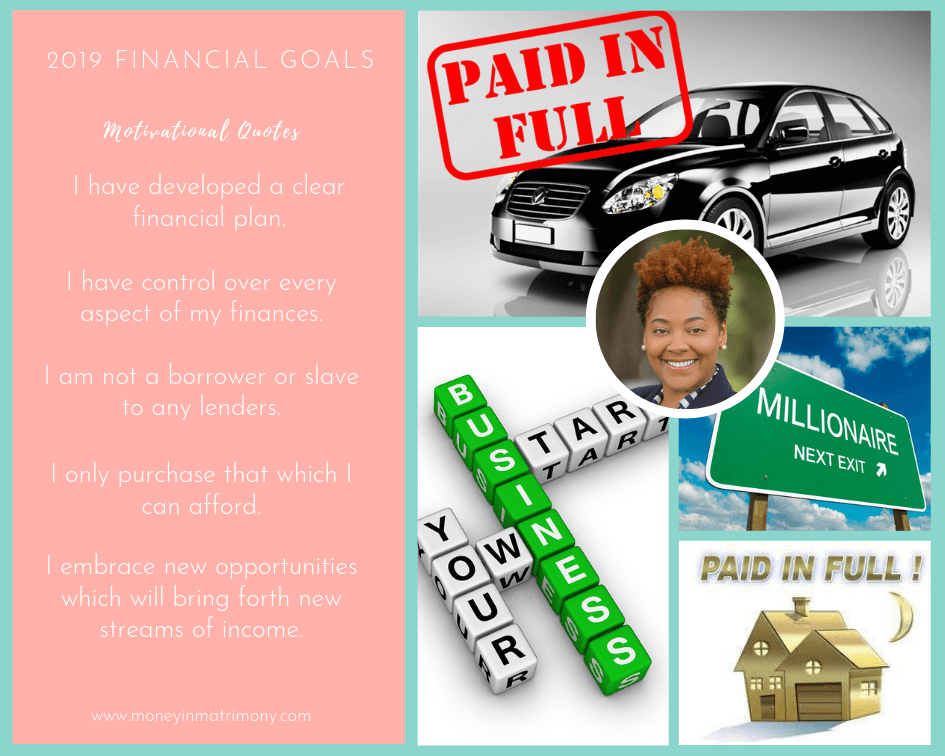

financial goals

Have you and your partner stalled on your financial goals? Have you both lost interest in trying to reach those goals because there just doesn’t seem to be a way out? Do your financial goals just seem to be unattainable? If you and your partner answered “YES” to any of these questions, then follow these 4 simple steps to catapult your financial goals.

1. Create a clear vision

2. Keep quiet

3. Believe it and you can achieve it

4. Begin with the end in mind

Before we dig deeper into these 4 simple steps to catapult your finances, I want to recommend that you first create a Financial Vision Board! Consider this a bonus step! I know. I know. You’ve already heard this 10,000 times before! However; I’ve personally seen how this can work in my own life and within my marriage. In addition to creating a Financial Vision Board, I have provided several steps below to help both you and your spouse achieve your financial goals!

What is a financial vision board?

A typical vision board might include the following components: mental & physical health, travel, career, business, spiritual wellness, relationships, and finances. A financial vision board is not much different than a regular vision board except the main focus is on the financial aspect of your life. A financial vision board can be broken down into several categories not limited to: Debt Payoff, Business Growth, Retirement, Giving/Tithing, Emergency Fund, Future Purchases, Wealth Building, Motivational Quotes/Scriptures or any other specific financial goals you and your partner may have.

To actually create your financial vision board, you and your partner can cut out pictures from magazines or print pictures that you find on the internet to place on your vision board. Other items needed for your vision board might include cork board, poster board, scissors, glue, tape, thumbtacks, markers, paint, and border. Feel free to get as creative as you want! For additional information on how to create a vision board, check out this video by Terri Savelle Foy.

Should couples create more than one financial vision board?

Absolutely! Couples should create individual financial vision boards in addition to joint financial vision boards. This is because each person has their own separate dreams and goals in addition to a separate vision for finances within the marriage. If you don’t have your own individual dreams and goals, then create some immediately! You must have your own identity within the marriage, which means you should have a separate financial vision for yourself!

Example

For example, one partner may have a short-term goal to save up $500 to purchase the latest new shoes, while the opposite partner may want to save $1,000 to take a weekend trip with some of his/her close friends. These goals are specific to each person and are independent of the joint financial goals. This is perfectly okay as long as neither spouse is committing financial infidelity to reach these individual goals. I’ll be writing a separate blog post on that topic in the near future!

4 Steps to Catapult your Finances

Now that you and your partner understand what a financial vision board is, let’s take some time to discuss the steps that will help you to reach your financial goals after you create your vision board.

1. Create a clear vision

While creating a financial vision board will certainly help you to create a vision for your finances, it also helps to write your financial goals down. If paying off your car in 2 years is your goal, then write down a detailed action plan to describe how it will happen. You can use the S.M.A.R.T. Goals technique to assist with this. A quick review of S.M.A.R.T. goals are goals that are Specific, Measurable, Attainable, Relevant and Timely. See the following examples below.

Goal # 1

What: Pay off my Car

When: 8/31/2021

How: Start a side-hustle that will bring in $300 extra per month on top of my regular salary.

Goal # 2

What: Purchase a New Handbag

When: 12/31/2020

How: Pick up 1 extra shift at work per month which will bring in an additional $150 each month.

2. Keep quiet

I actually learned this lesson the hard way. My husband and I were all pumped up about paying our student loans off. So, we shared this with two close friends and it was the worse decision we ever made. First, one friend tried to discourage us from paying the loans off because the person felt it was a bad idea and a waste of money. Then the other friend tried to make us believe that going to the grave owing the debt would be the best option because there would be nothing the student loan provider could do once we were dead!

“Everyone cannot handle your financial vision.”

We’ve heard our share of foolery on this topic which is why it is a must to keep quiet regarding your financial goals. Everyone cannot handle your financial vision! Your goals aren’t the same as theirs, which means that you can’t make your friends, family or co-workers understand why you and your partner would want to achieve a certain goal in the first place. So please, just keep your financial goals quiet. They are not meant to be shared with people who simply don’t have the capacity to understand them!

3. Believe it and you can achieve it

Creating a vision board will do nothing if you don’t first believe in your mind that your financial dreams and goals are actually achievable. You and your partner must believe, see and speak your vision into existence. You have to taste it! You must look at the vision board everyday and feel your financial dreams coming to pass. These goals must be on the forefront of your brain. Now, I’m not saying that you should drive yourself crazy thinking about achieving your financial goals, but there shouldn’t be a day that goes by, that you don’t at least think of ways to achieve the goals and how you will feel when that day actually comes, which brings me to my next point below.

4. Begin with the end in mind

You and your partner must constantly visualize yourself achieving your financial goals. You must visualize what you will do, how you will celebrate, and maybe what you will wear when that day comes in which you finally get to check this goal off of your list. You might even create another one! Ok, let me slow down a bit. LOL. Seriously though, this is a big day! You want it to be special. So, plan it out in your head first. Maybe it will happen the way you envisioned it, or maybe not, but no matter how it happens, at least you will be able to say I (we) saw myself (ourselves) accomplishing this goal.

Final ThougHts

A financial vision board alone will NOT help you and your partner to reach your financial goals. You must create an action plan to help you achieve the goals! Then you must put in the work! You will need to 1. Create a clear financial vision, 2. Keep your financial goals quiet 3. Believe that you can achieve your financial goals, and 4. Begin with the end in mind. I have personally followed these steps and within 3 months, I have already achieved one of my financial goals. Any goal will be achievable if you believe that it is attainable, see it happening and speak the vision into existence!