10 Powerful Ways Millennial Couples Can Become More Financially Self-Aware

This post may contain affiliate links which means that I will receive a small commission for purchases made through those links, at no cost to you.

Financial self-awareness is a critical component of financial success, especially for millennial couples navigating the complexities of marriage and money management. Being financially self-aware means understanding your financial habits, attitudes, and behaviors, and how they impact your financial health and relationship. For millennial couples, achieving financial self-awareness is the first step towards building a secure financial future together. In this blog post, we’ll explore ten practical ways millennial couples can become more financially self-aware.

1. Understand Your Financial Backgrounds

Every individual has a unique financial background shaped by their upbringing, experiences, and education. And understanding each other’s financial backgrounds is essential for millennial couples to build a strong financial foundation. Discuss how money was handled in your respective families, what financial lessons you learned growing up, and how these experiences influence your current financial habits.

Practical Tip: Set aside time for a financial history discussion. Talk about how your families approached money, what financial challenges you faced growing up, and how these experiences have shaped your views on money today. This list of guided conversational prompts will help you get started.

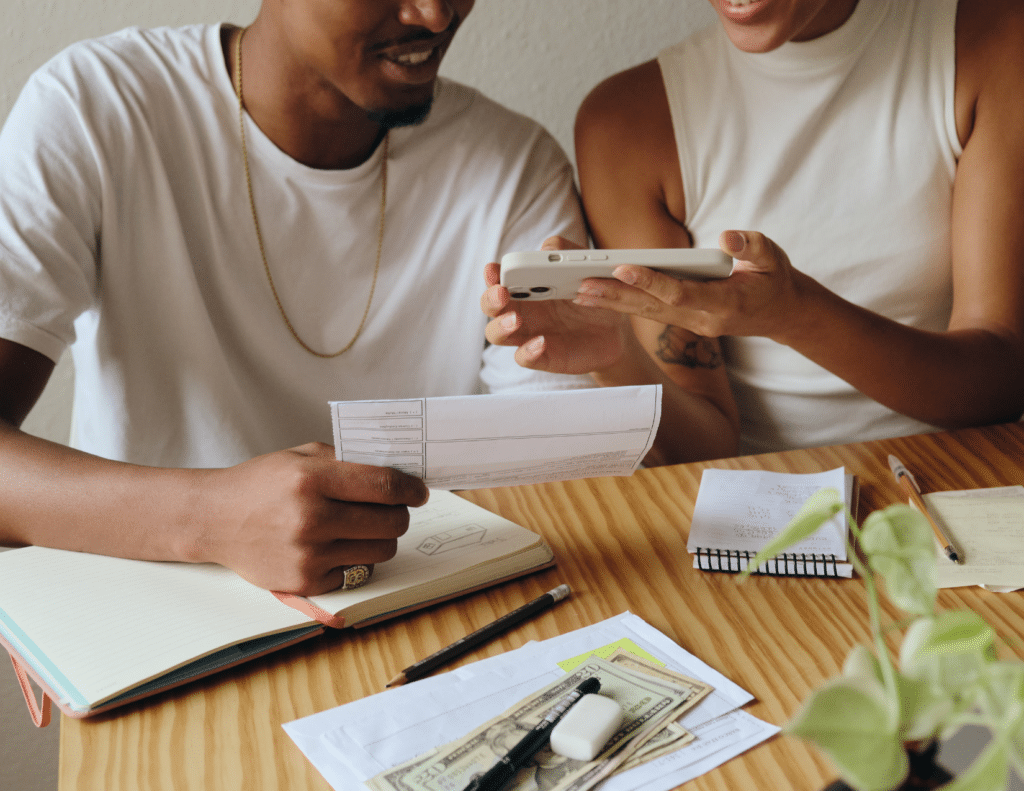

2. Track Your Spending Habits Together

Tracking your spending habits is a powerful way to gain insight into your financial behavior. By monitoring where your money goes, you can identify patterns, spot areas of overspending, and make informed decisions about your finances. For millennial couples, tracking expenses together can also help you align your financial goals and priorities.

Practical Tip: Use a budgeting app or spreadsheet to track your monthly expenses. Review your spending together at the end of each month to identify areas where you can cut back or reallocate funds.

3. Set Joint Financial Goals

Setting joint financial goals is an important step in becoming more financially self-aware as a couple. When you have clear, shared goals, you are more likely to be mindful of your spending and saving habits. Whether it’s saving for a home, paying off debt, or building an emergency fund, having a common goal can strengthen your financial partnership.

Practical Tip: Sit down together and discuss your short-term and long-term financial goals. Write them down and create a plan for how you will achieve them together.

4. Create a Budget That Reflects Your Values

A budget (or a spending plan) is more than just a financial tool; it’s a reflection of your values and priorities. For millennial couples, creating a budget that aligns with your values can help you make intentional decisions about how you spend and save money. It can also help you become more aware of whether your spending habits support or detract from your financial goals.

Practical Tip: Start by listing your non-negotiable expenses, such as rent, utilities, and groceries. Then, allocate funds to categories that are important to you, such as travel, entertainment, or savings. Regularly review and adjust your budget to ensure it aligns with your values.

5. Have Regular Money Dates

Money dates are a great way for millennial couples to stay financially self-aware. By setting aside time to discuss your finances regularly, you can stay on top of your financial situation, address any concerns, and make adjustments as needed. Money dates also help you maintain open communication about money, which is key to a healthy financial relationship.

Practical Tip: Schedule a monthly money date where you review your budget, track your progress towards your goals, and discuss any financial challenges. Make it enjoyable by pairing it with a meal or a fun activity.

6. Evaluate Your Financial Strengths and Weaknesses

Every couple has financial strengths and weaknesses. Identifying these areas can help you become more financially self-aware and take steps to improve your financial health. For example, one partner may be a natural saver, while the other struggles with impulse spending. By acknowledging these strengths and weaknesses, you can work together to find balance.

Practical Tip: Take time to assess your individual and collective financial strengths and weaknesses. Discuss how you can leverage your strengths and support each other in areas where you need improvement.

7. Reflect on Your Financial Decisions

Reflection is a key component of financial self-awareness. By reflecting on your past financial decisions, you can learn from your mistakes and successes. For millennial couples, reflecting on financial decisions together can help you avoid repeating the same mistakes and make better choices in the future.

Practical Tip: After making significant financial decisions, such as a large purchase or investment, take time to reflect on the process. Discuss what went well, what could have been improved, and how you can apply those lessons in the future.

8. Consider Your Emotional Relationship with Money

Money is often tied to emotions, and for many people, financial decisions are influenced by feelings such as fear, guilt, or insecurity. Understanding your emotional relationship with money can help you become more financially self-aware and make more rational financial decisions. For millennial couples, discussing how emotions impact your financial behavior can lead to a deeper understanding of each other and your financial dynamics.

Practical Tip: Open up to your partner about how money makes you feel. Discuss any financial fears or anxieties you may have and explore ways to manage these emotions together.

9. Educate Yourselves on Financial Literacy

Financial literacy is the foundation of financial self-awareness. The more you know about personal finance, the better equipped you are to make informed decisions about your money. For millennial couples, increasing your financial literacy together can help you navigate financial challenges and opportunities with confidence.

Practical Tip: Commit to learning about personal finance together. Read books, attend workshops, or take online courses on topics such as budgeting, investing, and retirement planning.

10. Seek Professional Financial Advice

Sometimes, becoming financially self-aware requires the guidance of a professional. Financial advisors can provide valuable insights into your financial situation, help you identify areas for improvement, and offer strategies for achieving your financial goals. For millennial couples, seeking professional financial advice can be a game-changer in your journey towards financial self-awareness.

Practical Tip: Schedule a consultation with an accredited financial coach, financial therapist or a trusted financial coach. Discuss your financial goals, challenges, and any areas where you need guidance. A professional can help you create a personalized financial plan that aligns with your values and goals.

Conclusion

Becoming more financially self-aware is an ongoing process that requires open communication, reflection, and a commitment to growth. For millennial couples, financial self-awareness is the key to building a strong financial foundation, achieving your goals, and maintaining a healthy financial relationship. By implementing all or even some of these ten strategies, you can increase your financial self-awareness and take control of your financial future together.

Final Thoughts

Financial self-awareness is not just about numbers; it’s about understanding your financial habits, emotions, and values. By becoming more aware of how these factors influence your financial decisions, you can make better choices and build a more secure financial future with your partner. Start today by having an open and honest conversation about money with your partner, and take the first step towards financial self-awareness.